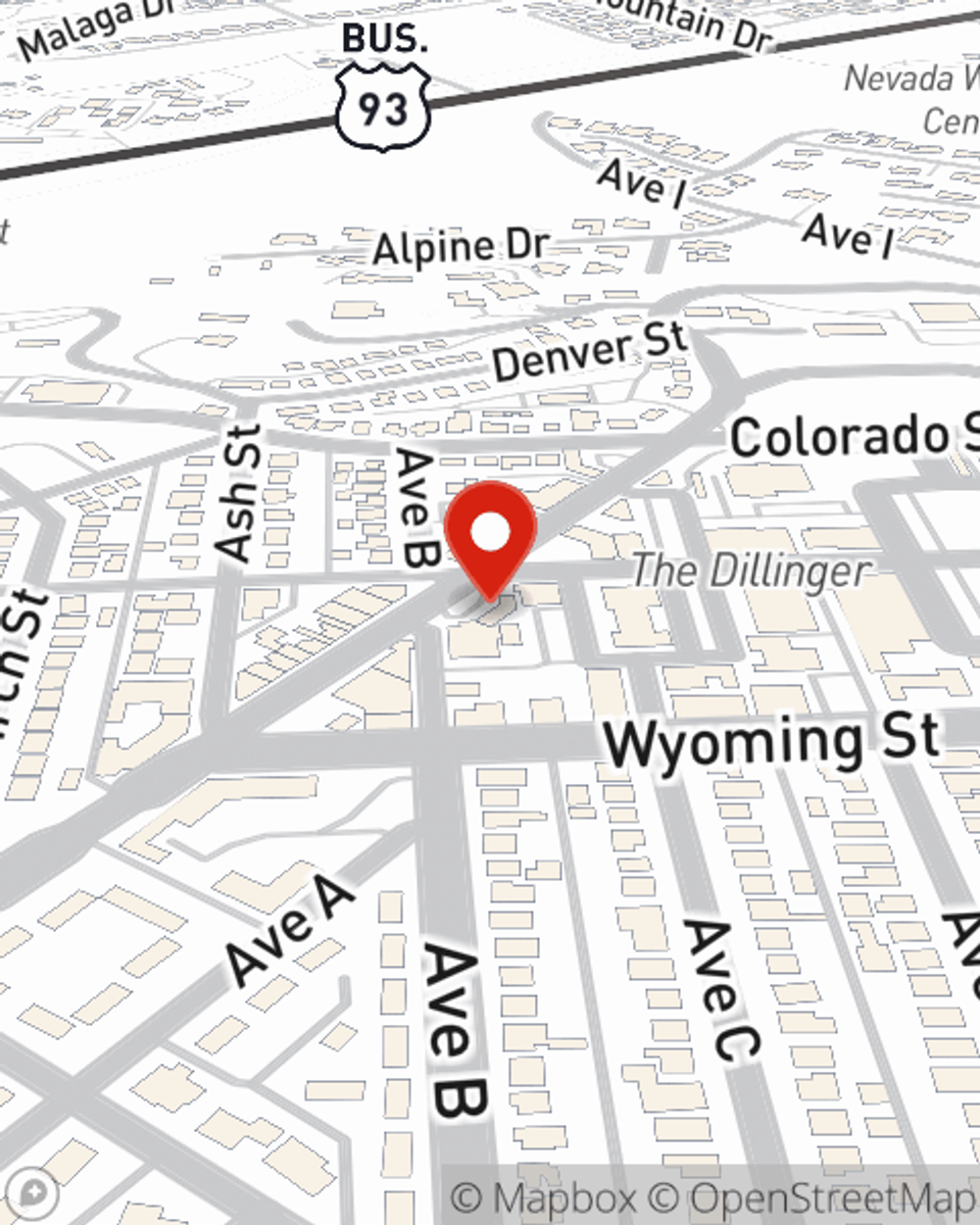

Business Insurance in and around Boulder City

Get your Boulder City business covered, right here!

Cover all the bases for your small business

Your Search For Remarkable Small Business Insurance Ends Now.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Steve West help you learn about excellent business insurance.

Get your Boulder City business covered, right here!

Cover all the bases for your small business

Insurance Designed For Small Business

For your small business, whether it's a bridal shop, an antique store, a deli, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like accounts receivable, extra expense, and business liability.

It's time to get in touch with State Farm agent Steve West. You'll quickly perceive why State Farm is one of the leaders in small business insurance.

Simple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.

Steve West

State Farm® Insurance AgentSimple Insights®

Importance of a business continuation plan

Importance of a business continuation plan

Find out why it's important to have a business succession plan in place before the time of death to benefit the surviving owners and heirs.

Rental trends: What landlords and tenants need to know

Rental trends: What landlords and tenants need to know

Understanding the current trends surrounding the rental industry will help both landlords and tenants understand how to navigate this changing landscape.